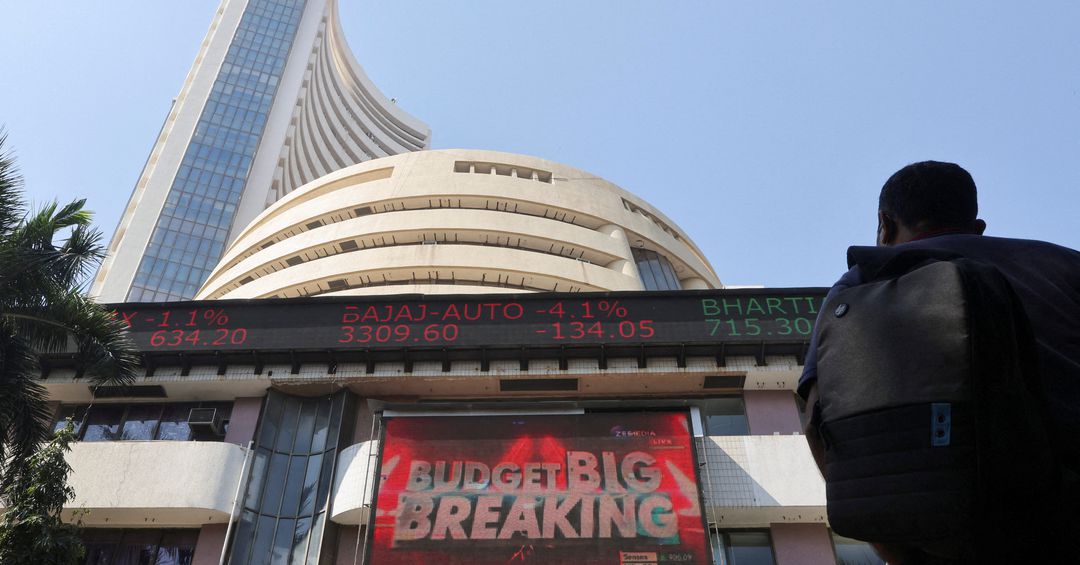

Indian shares hit a two-week high led by financial stocks on Wednesday, after the government stepped up spending to fuel growth in the pandemic-hit economy, although disappointing earnings from Tech Mahindra capped gains.

The blue-chip NSE Nifty 50 index rose 0.87% to 17,729.5 as of 0541 GMT, and the S&P BSE Sensex advanced 0.91% to 59,396.13.

On Tuesday, the indexes had climbed nearly 1.5% each after the federal budget unveiled increased spending to 39.45 trillion rupees in the coming fiscal year to build public infrastructure and drive economic growth. Concerns over increased borrowing figures and the fiscal deficit had also sent bond yields higher.

“The capex-driven budget will drive credit growth in the economy, so we may see benefits for the banking sector. Which was a laggard,” said Anita Gandhi, director at Arihant Capital Markets. Adding there was some comfort on the sector’s valuation and around asset quality.

“The only concern is from rising yields, both globally and domestically. We will also have to see how foreign investor numbers stack up from now on”. The benchmark 10-year bond yield spiked to 6.922% on Wednesday from its last close of 6.8279%.

“Shares related to the capex cycle and related credit growth are in the nascent stage of a growth cycle. And valuations are nowhere close to the euphoric valuations visible in the ‘growth and low volatility’ stocks in the market,” ICICI Securities said in a note.

Non-bank lender Bajaj Finance gained 3.7%, while Bajaj Finserv jumped 5%. Tech Mahindra fell 4.2% after the IT services company missed expectations for quarterly profit on rising wage costs. Heavyweight mortgage lender Housing Development Finance Corp climbed 1.8% ahead of its quarterly results.