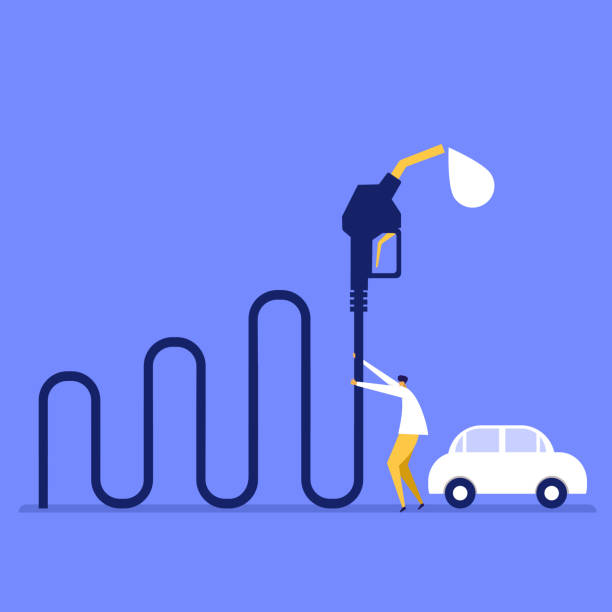

The government of India has today increased the export duty on petrol. Alson on diesel, and ATF, a move that could help meet domestic demand. Export duty on petrol has been raised by Rs 6 per litre and Rs 13 per litre on diesel. Export duty on ATF has been upped by Rs 6 per lire. It must be noted that an increase in export duty on the various fuels will not increase domestic fuel prices. The government has also directed exported to sell 50% of their petrol. They will sell in domestic markets and 30% of diesel as well. The move will also help the government’s kitty as it looks to benefit from the rising crude oil prices.

Further, another notification from the government showed it has slapped a Rs 23,230 per tonne additional tax on domestically produced crude oil to take away windfall gains accruing to producers from high international oil prices. The move could fetch the government Rs 67,425 crore annually on 29 million tonnes of crude oil produced domestically, news agency PTI reported. The tax on exports is an attempt to benefit from the high crude oil prices while private sector refineries reap huge gains from exporting fuel to markets such as Europe and the US. The tax on domestically produced crude oil follows local producers reaping windfall gains from the surge in international oil prices.

Domestic petrol and diesel prices have been steady since May 21 when the government announced a cut in prices. Domestic prices are likely to remain low. As the taxes announced today by the government do not impact domestic fuel prices