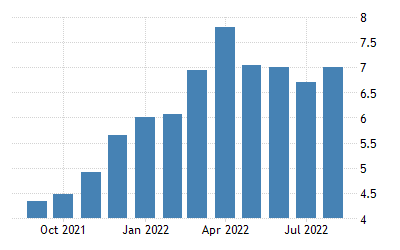

India’s retail inflation – as measured by the consumer price index (CPI) – surged to 7% in August, due to higher food prices, compared to 6.71% in July. The number has remained above the Reserve Bank of India’s comfort zone of 2-6% for the eighth consecutive month.

Food inflation, which accounts for nearly half the CPI basket, soared 7.62% in August 2022 as against 6.75% in July, according to the data released by the National Statistical Office on Monday.

Despite India restricting wheat flour exports towards the end of August, inflation touched 7% in August. This may add pressure on the central bank to hike interest rates more aggressively in the coming months to tackle elevated inflation.

Meanwhile, industrial growth, as measured by the Index of Industrial Production (IIP), tumbled to 2.4% in July as compared to 12.3% in June.

Aditi Nayar, Chief Economist at ICRA said, “The IIP growth plunged to a four month low of 2.4% in July 2022, trailing our expectation of 4%.

RBI on key policy rate

The central bank has hiked key policy rate by 140 basis points in May-August, returning borrowing costs to pre-pandemic levels. The RBI’s next policy decision is due on 30 September. The central bank expects inflation to average 6.7% in the year to March.

In the first three months of the current fiscal, retail inflation remained above 7%.

Indian government bond yields ended marginally higher today, ahead of the key retail inflation data. The benchmark 10-year bond yield ended at 7.1811%, compared with 7.1699% in the previous session.

Despite the recent moderation, the RBI is expected to hike the repo rate by another 60 basis points through the end of March to 6.00% from a pandemic-era record low 4.00%, a separate Reuters poll showed.