ITR filing: The last date to submit the income tax return (ITR) for the financial year 2022-23 or assessment year 2023-24 without incurring any penalty is July 31, 2023. It is recommended to file the return before the deadline. The tax department has been sending reminders to ensure timely filing.

Importance of filing ITR

ITR filing is an annual activity seen as a duty of every responsible citizen of the nation. You can claim the refund of the excess tax paid/deducted during a financial year by filing it. Also, ITR can be used as proof of income and address.

Where to file

The I-T department has established an independent portal for e-filing of income tax returns — incometaxindia.gov.in. Additionally, there are certain private entities, registered by the Income Tax department that allows you to e-file through their websites. Also, offline filing is available.

Forms available

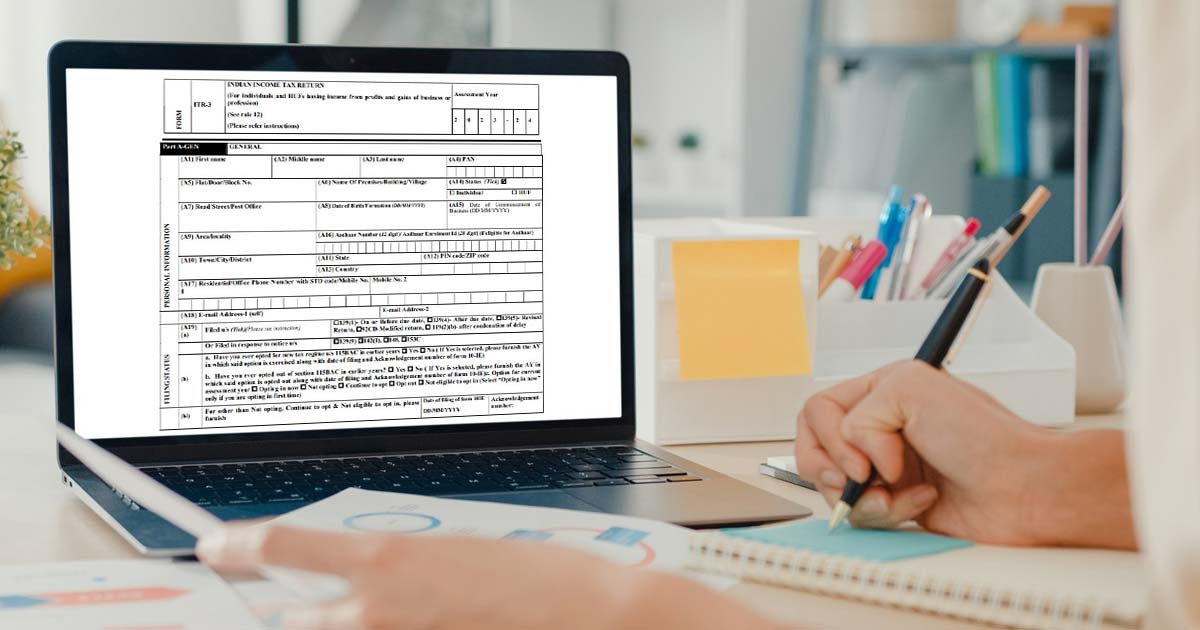

Under the current income tax laws, 7 forms are available for different types of assessees to file their income tax return- ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7.

For example, ITR-1 is applicable only for resident individuals having income up to Rs 50 lakh and only for those having income from salary, one house property and other sources. Similarly, there is ITR-3 which is applicable for income from business or profession and ITR-4 for the presumptive method of taxation such as for freelancers. Taxpayers should be careful while choosing the ITR form. A wrong form can render the tax return filed defective.

Documents required in ITR filing

While you don’t need to attach any documents with ITR forms, documents like Aadhaar card, PAN card, tax-saving investment proofs, form 16, form 26AS, rent receipts, deduction proofs can help you in filing ITR.

ITR verification

After filing ITR, it is imperative to verify it. In case the verification is not done, ITR cannot be regarded as legal. It may not be processed by the department.

I-T Department offers five ways for verification of an ITR: net banking, bank ATM, Aadhaar OTP bank account and demat account.

Mistakes to avoid in ITR filing

While filing the returns, you must ensure to provide the correct assessment year. For FY 2021-22 the correct corresponding AY is 2022-23. Additionally, you should verify the TDS and tax payments with form 26AS before filing. The ITR forms carry several rows and columns that need to be filled out at the time of filing one’s income tax returns. The details have to be entered in a particular format, which if not done properly can lead to errors.